Love & Money

You found love! (Congratulations) You found this person that makes you genuinely happy: You are at peace when you are together, and you can’t imagine anyone with whom you are more compatible. That’s all we need right? Love.

But relationships are the trickiest of business. Even if you are with your romantic perfect fit, other factors heavily influence your life and could make Mr. or Mrs. Right stop looking that perfect—especially if you don’t manage it well, and what is a bigger factor than money?

Money impacts every aspect of our lives; relationships are not an exception (especially for couples living together or married). After infidelity, money fights are the second most cited cause for divorce. Don’t panic! Since we are romantic lovey dovey cetacea, we came up with a list of ideas that should keep moolah heartaches away.

Jump Ahead to

Money Talks

You need to have an open, honest and peaceful (very peaceful) conversation about money with your partner. The earlier in the relationship the better. The discussion must be had from a leveled place, where no party has a dominance, and it should include disclosure of each other’s finances: What are the economic goals individually and as a couple? What are the savings and spending habits and what are your partner’s specific triggers that create anxiety related to money?

No monologues allowed. There’s no lecturing in this conversation. It is about aligning goals and expectations, not dictating them. Exorcise those demons and bring them out. If your partner cannot find happiness when shoes are not bought frequently enough, then try find a compromise that keeps everyone sane. You might think it is not really that relevant to disclose that you carry $70,000 in credit card debt. But I’m going to go out on a limb here and insist that it is important for your partner to know.

How about your partner wants to save money to buy a boat while you are on a mad saving path to buy a house; What? I never mentioned I pay alimony to my previous partner? I could swear I told you…where’s my mind? Ops!

The “B” Word

Now everything is out in the open: Your partner knows about your secret money stash; your Sephora shopping addiction has been properly disclosed, and everyone knows the size of the student debt. Great! One step closer to eternal smooching.

Now, it is time to address the “B” word: Create a Budget.

Talk about your lifestyle choices. Sometimes the choices are as simple as those that you can afford: Make sure you know what your incomes can support and discuss it. The budget is not created by one partner, so the other can just adhere to it. It should be created in consideration of all the things discussed during the “Money Talks” and preferably follow the 50/30/20 rule. The budget is meant to be the result of the couple’s compromise and the financial roadmap that both are agreeing to follow together.

It is Not a Competition

Chances are that one of the partners makes more money than the other. One of the partners (by choice or not) might be making zero. In any case, whether you make $100 or $100,000 more than your partner, it is all part of the “Ours Fund”. You are a team now, or at least trying to become one. If you try to use that extra income you are bringing in as a power play and trying to have the most say on where the money goes, you are surely creating a love killing situation.

Remove ego from the financial situation. You are not the “provider,” a self-elected titled that gives you the power to control. Or, on the flip side, bringing less money in does not make you an inferior. Both people are integral parts of the relationship independent of their earning power.

No matter what—Don’t make your favorite person feel inferior. It is not nice nor smart—c’mon you are better than that. Use money to grow together, not to manipulate. Just because you have a joint account does not mean that you can slip into money controlling mode. Make decisions together, control together, regardless of respective earning power.

The More You Know

Transparency. You had the talk; you have a budget; you are working as a team; you are the financial equivalent of a John Legend song—Fantastic!

Now, are you keeping your partner updated on income? Are there any out of budget expenses that are strategically being kept out of sight and out of mind? Did you fall off the shopping wagon?

Some couples have found it easier to deal with transparency by having joint accounts and credit cards. Others find having all commingled more problematic. Whatever works for you. The important thing is to have your partner informed. Disclose, good or bad. Don’t let bad habits build up or be caught in a lie (Yes! hiding that extra cash bonus you received at work, so you can spend it on your own is a lie).

Never, never, never, commit “financial infidelity.” This happens when couples acquire relevant debt without one partner knowing, or make large discretionary expenses from a hidden account or have undisclosed additional sources of income. In any case, getting caught in financial infidelity is as damaging to the relationship as cheating (they really are not that different…are they?)

Keep Debt on Check

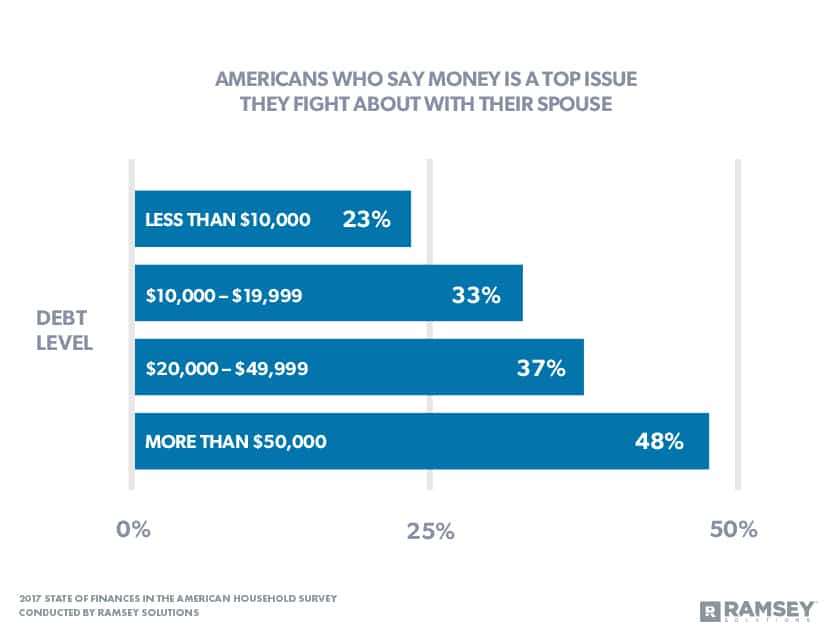

Data consistently shows that the higher the debt for couples, the higher the chances of money related fights. Almost half of the couples with more than $50,000 in debt say money is a top reason for arguments.

Don’t take debt that is not necessary. Do you really need that or is it just an ego driven expense. Don’t try to outsmart the statistics, as we said before relationships are tricky already. Why add the additional complication of unnecessary debt.

Ask for Help

Sometimes even though you try your hardest, you can’t effectively communicate with your partner about money or compromises are impossible to reach. Maybe it is hard to change your partner’s or your own behavior. In this case, look for help. A financial advisor could assist, maybe a financial mediator, your marriage counselor, your rabbi, your priest or your pastor. Whomever you pick that can assist is fine. Just make sure it is not someone with an agenda or biased. Never ask your parents or other family members to intervene (no, it is never a good idea to ask your dad to explain to your partner how poorly of a money manager your partner is).

We are all always in the pursuit of happiness. Having someone you love and that loves you back is what makes us humans. However, it is very hard to be happy if you and your loved one are not at peace with your finances. Financial wellness is an integral part of your overall wellness—this includes your partner, and the overall health of your relationship. Don’t avoid the conversation. It is, in fact, unavoidable.

Pro Tip:

For those of you intense, over-eager lovers that want to be proactive. You can preemptively screen for financial health when deciding if that person is a good candidate to be your better half. Ask these questions before getting too serious…We are not being cynical, just proactive:

- Do you have debt? How much? No judgement, it is just relevant for planning a future together. Understanding spending habits, lifestyle choices and the size of the debt can help you decide if you can afford to live together as a couple at the moment.

- What’s your credit score? Unfortunately, a lot of times we are financially measured by our credit score. Your future partner’s credit score will impact your access to financing, your insurance costs and making major purchases like a home or a car. Additionally, it will give you a good idea of the financial discipline of your partner.

- Do you have financial goals? What are they? Knowing if your future partner has financial goals will show you how organized and strategic, he or she is about finances. Knowing what is important to this person, can shine light on how difficult or easy aligning financial goals will be in the future.